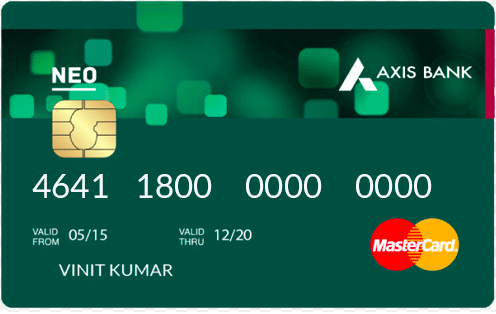

The Axis Bank Neo Credit Card is tailored for individuals who frequently engage in online shopping. This credit card comes with a host of benefits, including attractive offers, cashback rewards, and loyalty points on transactions made on leading e-commerce platforms like Amazon, Flipkart, Myntra, BookMyShow, and more.

Key Highlights

- Welcome offers from Amazon, cashback offers, gift vouchers, and entertainment perks.

- No-cost EMI facility available for select products.

- Lost card liability insurance provided.

- Lifestyle benefits covering dining, movies, and shopping.

- Rewards program offering 2 rewards points for every Rs. 200 spent.

- Secure transactions with an embedded EMV chip.

- Zero lost card liability insurance.

- Dining privileges with discounts at partner restaurants.

- Movie vouchers and entertainment benefits.

- Flexible EMI facility for high-value purchases.

- Variety of shopping offers and discounts.

Credit Card Details:

| Feature | Details |

|---|---|

| Card Name | Axis Bank Neo Credit Card |

| Type | Lifestyle and Rewards Credit Card |

| Annual Fee | 3.50% of the transaction amount |

| Joining Fee | Rs. 250 |

| Add-on Card Joining Fee | Nil |

| Add-on Card Annual Fee | Nil |

| Interest Rate (Retail Purchases) | 3.6% per month (52.86% per annum) |

| Cash Withdrawal Fee | 2.5% of transaction amount (Minimum Rs. 500) |

| Foreign Currency Transaction Fee | 3.50% of transaction amount |

| Late Payment Fee | – Nil for total due up to Rs. 100 – Rs. 100 for Rs. 101 to Rs. 300 – Rs. 300 for Rs. 301 to Rs. 1,000 – Rs. 500 for Rs. 1,001 to Rs. 5,000 – Rs. 600 for Rs. 5,001 to Rs. 20,000 – Rs. 700 for above Rs. 20,000 |

| Over Limit Penalty | 3% of the over-limit amount (Minimum of Rs. 500) |

| Cash Payment Fee | Rs. 100 |

| Duplicate Statement Fee | Waived |

| Cheque Return Fee | Rs. 300 |

| Hotlisting Fee | Nil |

| Balance Enquiry Charges | Waived |

| GST | As per existing Government norms |

| Reward Redemption Fee | Yes |

| Dynamic Currency Conversion Markup | 1% plus taxes |

| Card Replacement Fee | Nil |

| Interest-Free Period | 20 to 50 days (Varies based on the transaction date) |

| Minimum Income Requirement | Not specified |

| Eligibility Age | – Primary cardholder: 18 to 70 years of age – Add-on cardholder: Over 15 years |

| Documents Required | – Filled out credit card application form – Copy of PAN card or Form 60 – Identity proof, residence proof, income proof – Passport-size color photographs |

Lifestyle Benefits

Dining Privileges

Enjoy attractive dining benefits at partner restaurants in India under the Axis Bank Dining Delights program.

Gift Vouchers

Receive Jabong gift vouchers and movie vouchers, enhancing your shopping and entertainment experiences.

Rewards Program

- Earn 2 reward points for every Rs. 200 spent using the Axis Bank Neo Credit Card under the eDGE Loyalty Program.

- Redeem rewards points from an exclusive catalog on the Axis Bank website.

Secure Transactions

The Neo Credit Card comes with an embedded EMV chip, ensuring enhanced security for your online transactions.

Lost Card Liability

Axis Bank offers zero lost card liability insurance to Neo credit cardholders. Report the loss to the customer care service to protect your transactions.

EMI Facility

- Convert high-value purchases into equated monthly installments.

- EMI tenures range from 6 to 24 months.

- Available for purchases of Rs. 2,500 or higher.

Latest Offers

Shopping Offers

- Get discounts on Myntra, BigBasket, Croma, Reliance Digital, and Snapdeal.

- Enjoy cashback on mobile recharge transactions made on Freecharge.

Movie Offers

- Avail discounts on movie ticket bookings on BookMyShow.

Travel Offers

- Opt for easy EMI payments for travel bookings on Yatra and Goibibo.

- Get discounts on domestic and international flight bookings made on EaseMyTrip.

How to Redeem Reward Points

- Log in to your net banking.

- Select ‘Account Summary’ and click on ‘Axis eDGE Rewards.’

- Accept terms and conditions and click ‘Redeem Now.’

- Choose the reward category, add rewards, and confirm.

Fees and Charges

| Type of Charge | Amount |

|---|---|

| Joining Fees | Rs. 250 |

| Annual Fees | Rs. 250 |

| Add-on Card Joining Fee | Nil |

| Add-on Card Annual Fee | Nil |

| Card Replacement Fee | Nil |

| Cash Payment Fee | Rs. 100 |

| Duplicate Statement Fee | Waived |

| Overdue Penalty or Late Payment Fee | Varies based on due amount |

| Over Limit Penalty | 2.5% of over-limit amount |

| Cheque Return or Dishonour Fee | 2% of payment amount |

| Foreign Currency Transaction Fee | 3.50% of transaction value |

| GST | As per existing norms |

Eligibility

- Primary cardholder: 18 to 70 years of age.

- Add-on cardholder: Over 15 years.

- Resident or non-resident of India.

Documents for Application

- Filled credit card application form.

- Copy of PAN card or Form 60.

- Identity proof, residence proof, and income proof.

- Passport size color photographs.

Apply for Axis Bank Neo Credit Card Online

- Apply through Axis Bank website or BankBazaar for a paperless experience.

- Check eligibility, submit information, upload documents, and track application status.

FAQs

How can I pay my Axis Bank Neo Credit Card dues?

Offline methods include cheque, cash, draft, and ATM payments, while online options comprise auto-debit, NEFT, net banking, mobile banking, and more.

Are there extra charges associated with the card?

Refer to the fees and charges table for a comprehensive list.

Does Axis Bank offer a credit-free period?

Yes, the interest-free period varies based on the transaction date.

What to do in case of a lost card?

Contact Axis Bank's customer care to report the loss and protect your transactions.

Can I get duplicate statements?

Yes, provided all outstanding dues are paid.

How long does it take to receive the card after applying?

The bank takes around 2-3 weeks to deliver the card to your address.

Can NRIs apply for the card?

Non-resident Indians can apply with proper KYC documents.

How to check application status?

Call customer care or log in to net banking for application status.

How to view e-Statements?

Log in to net banking, select 'Credit Card,' and click 'View Statement.'

Can minors apply for the card?

Minors can't apply directly; parents can apply on their behalf for an add-on card.

Disclaimer: The credit card decision would be communicated within 21 working days.

Benefits Snapshot

Monthly Benefits

- Amazon Pay Voucher: Rs. 250

- Zomato Voucher: Rs. 200

- Blinkit Gift Voucher: Rs. 250

- PharmEasy Subscription: Rs. 249

- Food Ordering at Zomato: Rs. 240

- Utility Bill Payments via Amazon Pay: Rs. 150

- Grocery Shopping at Grofers: Rs. 250

- Movie Spends on BookMyShow: Rs. 100

- Online Shopping at Myntra: Rs. 100

- Edge Rewards: Rs. 100

- Total Benefit (Year 1): Rs. 11,129

Annual Benefits (Year 2 Onwards)

- Total Benefit: Rs. 10,180

- Annual benefits as a percentage of spends*: 10%

*For illustrative purposes only.

Conclusion

The Axis Bank Neo Credit Card is a versatile choice for online shoppers, offering a range of benefits, rewards, and discounts across various categories. With its secure features and valuable perks, this card is an excellent option for those looking to enhance their online shopping experiences.